Financial Modelling

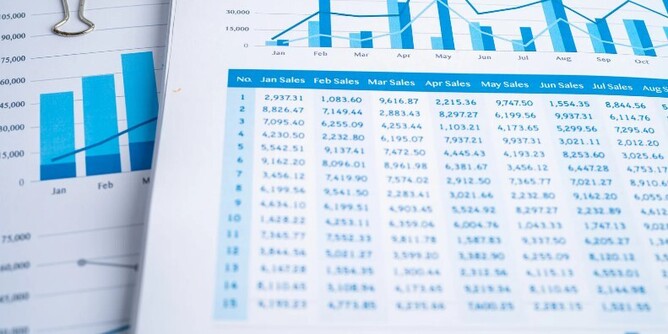

Building a good financial model comes down to balance and materiality. Ideally, you want to create a model that:

(a) provide great visibility on assumptions on key drivers

(b) Users can have the ability to make changes on the assumptions easily and quickly

(c) The impact on the changes in the assumptions on Profit and Loss and cashflow can be presented quickly by the users.

On the other hand, you don’t want a financial model that is too detailed, hard to maintain and update. It is easier said than done and it often comes down to experience.

Guiding Principles

One of the guiding principles that I use when building financial models is to consider the next person who will take over the model. Assuming that person is a competent spreadsheet user, will he/she be able to pick up the model with relative ease? I can spend hours talking about this topic. Let’s not try to bore you with too many details, here are my top 5 tips:

(1) Put all your assumptions in separate sheet(s) away from the reports and calculations.

(2) All calculations and reports should be all formula driven and avoid hard coding any numbers within the formulas. All the numbers input should always link back to the assumption sheet.

(3) Avoid complex formula that are not commonly used.

(4) If you have a long formula, break it down into multiple formulas so other users can find it easier to follow

(5) Always try to cross reference subtotal / totals across different sheets and check for errors or discrepancies, if possible.

Excel vs Google Sheet

Why do most accountants prefer Excel over Google Sheet?

This question is like asking a software developer or graphic designer why they prefer Apple over Microsoft. While Google Sheet is free, better for team collaboration and version control, Excel is so much quicker and easier for building financial models. As Google Sheet is a cloud-based tool, building and operating a large model can be slow and it often become very frustrating for the model builder or the person who use the model on a regular basis. For me to build the same model in Google Sheet, it would easily take 2x more time to do compared to Excel, as Google Sheet often become laggy and slow when the size of the model gets bigger. All these reflects on time required which means costs to the customers.

Other Cloud Base forecasting Tools

There are many affordable online forecasting tools available. What we have often found is that most of the affordable online forecasting tools can only cater for simple forecasting needs and don't provide the flexibility needed for building a model that is fit for capital raising.

Standard Template

You can definitely try a standard template online or use the NZTE financial model template as a starting point. Every business is unique, and their drivers are different, most standard template doesn’t cater the need to build a good financial model well. We often found standard template are very restrictive and founders quickly found that they needed to create their own model which better reflect their business drivers and assumptions.

How much details and information do I need to include?

It highly depends on the stage of the company and the type of investors you are targeting. For pre-seed stage companies targeting friends and families or experienced angel investors / VCs, a relatively high-level forecast will likely be sufficient. However, if you are raising a seed / post seed round and/or your target investors are strategic investors, corporates, trust, impact funds / investors or investors who don’t have a lot of experienced with start-up investments, then you will likely need to have a more detailed financial model.